The person that you’re seeing at the left is Sam Bankman Fried. He is the founder of FTX, a bitcoin exchange company. He is a fan of playing league of legends. Sequoia Capital, a vulture company (a company who finances smaller companies or businesses to grow them) funded $210M in FTX in 2020. Sequoia also funded $2M to one of the top Bangladeshi companies which is Robi 10 minutes school. Well the investment of $210M dollar to FTX company took place online due to covid pandemic. It was said that Sam bankman fried was playing league of legends while answering the questions of the investors from sequoia. Can you imagine how talented this guy is? A million dollar investment is going on for his own company and he’s carelessly playing computer games. He was one of the billionaires of the world. Yes, he ‘was’ a billionaire. But, on November 11th, 2022 he got bankrupt and now his company FTX is worth 1$! Again, Elon musk is one of the greatest people, also my idol is becoming the more & more billionaire by investing in crypto and also making the most impossible things in this world possible like a God. Many consider him as the Iron Man of the world. Want to know how all these things are happening with bitcoin and how one is getting bankrupted and another one shaping the world. Well no worries cuz today i will discuss what bitcoin is and how it will become the future of the world economy.

The currency and the economic system that we’re witnessing now was not like this from the very beginning of human civilization. In the early ages our ancestors used to follow the exchange method. It means to exchange (goods or services) for other goods or services without using money. For example, giving someone eggs to buy some fruits or taking fruits from someone to give him/her some bread. The system of exchange was known as Barter. But this system has a problem which is, the thing that i’ve to exchange may be of no use to the person whom i’m going to exchange with. As a result I can't do the exchange and buy anything. Soon humans realized the problem and came to a conclusion that they should use a medium which will define the price of the exchangeable items. Things like domestic animals, pebbles and then valuable metals such as gold were used as the medium of buying something. Hundreds of years after this when the state and government system was invented people decided to use note currency as a medium. The value of this note currency will be determined using gold. For example 1Oz of Gold = $20.67. This system is known as, “Gold Standard ''. But in 1971, the US government and many other countries adopted the Gold Standard system. Which means that the value of the dollar will no longer be determined by using Gold. Rather it should be decided by the government and with the people’s consent. Because of this system the government and central banks gained more influence on money which made it easier to change the monetary policy during the economic crisis. This type of money is known as, “Fiat Money '' whose value isn’t determined using gold, rather it’s actually determined by the trust of people in government. But what if we don’t believe in the government?

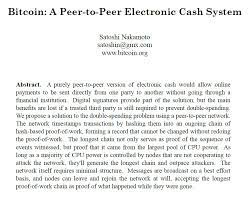

In the 1980s the “Cypherpunk” community emerged which was against the government. Because according to them the government could easily manipulate the peoples and the economy by spamming the information and data of civilians. Cypherpunk gave the idea of “Cryptography” by which without any government surveillance people can exchange information. Later, Bitcoin used the idea of Cypherpunk. In 2007 & 2008 the world witnessed an economic fall due to a rising number of borrowers unable to repay their loans. Because of this bankruptcy one of the largest banks in America fell down, whose name was “Lehman Brothers”. During this economic crisis in 2007-08, a document named “White Paper” emerged whose headline was, “Bitcoin: A peer to peer electronic cash system”. And the writer of the article was Satoshi Nakamoto, the so-called founder of Bitcoin. The document had 9 pages where Nakamoto explained his electronic cash system method by which two people can exchange digital currencies without taking any help from economic institutions a.k.a. Banks. Nakamoto used the idea of cypherpunk which we at present known as, “Blockchain”. Using mathematics, computer science & cryptography Nakamoto invented this Bitcoin which is supposed to be the very first cryptocurrency in the world. The main goal of inventing this bitcoin was to solve the trust issue between people and the government.

Let’s stop here. So far we came to know about the history of bitcoin. Now let us know what bitcoin is. How does it work? Can we carry it in our moneybag? Bitcoin actually doesn't have any physical existence. It’s totally a digital currency. Yes it has no physical existence no matter how good it looks like those old chocolate coins. To know how bitcoin works we’ve to know how blockchain works. Now blockchain is a very complicated and vast process. But in simple language it can be compared with the account book of banks for our better understanding. Banks also work in the similar process. A bank stores all the transaction information from an account in their system by which they can easily understand if the transaction was legal or illegal. This ensures that a person can’t totally use all the money in his/her account i.e. if a person has 100,000 taka in his/her account he/she won’t be able to use all the 100,000 taka from the account. Now this may sound cruel but actually this is for the benefit of that person so that the person can save some money for emergencies. But bitcoin doesn't work like that.The goal of bitcoin is decentralization of coins. Nakamoto used a peer -to -peer laser system or distributed laser system for the transaction. Sounds complicated doesn't it? Well let me get this easier for you. Instead of using the account books that the banks use to store transaction records from an account, bitcoin uses distribution i.e. distributes all the transaction information in the nodes of the computers in the bitcoin network. Anyone can enter the network of bitcoin by simply installing the software of bitcoin in his/her computer. Whenever there is a transaction the computer will use complex algorithms to detect whether the transaction is legitimate or not. If all the computers connected with the nodes in the bitcoin network agree that the transaction is legitimate only then the user’s computer will store the transaction information in it. If a single node of a computer tries to display an illegal transaction as legitimate, other computers in the network will disagree. Every node and tail stores the information of the transaction along with the account book. And during this transaction, the private information of the person is kept secret. The process of keeping all the information of the transaction is also quite complex. Every person in the bitcoin network has two keys. One is the Public key and the other is the Private key. Private key is used as a digital signature and a public key is used to verify the authenticity of the private key. This detection process in blockchain is known as, “Mining”. The person who will mine the block will be known as a miner. Every miner must get some bitcoin as reward for mining, which they can later on use for further mining. If a hacker can successfully hack and crack into any block of the blockchain then all other blocks which were connected afterwards will also get cracked/hacked. Any random person in the network can see the transaction data in every block but can’t change it. For this we can still see who mined the first block. As we can see, Satoshi Nakamoto mined the first block and got 50 bitcoin (BTC) as reward. This first block in the blockchain is known as, “Genesis Block”. While writing the software code in bitcoin nakamoto set the supply limit of bitcoin 21M. At present only 2M bitcoin are available to mine.

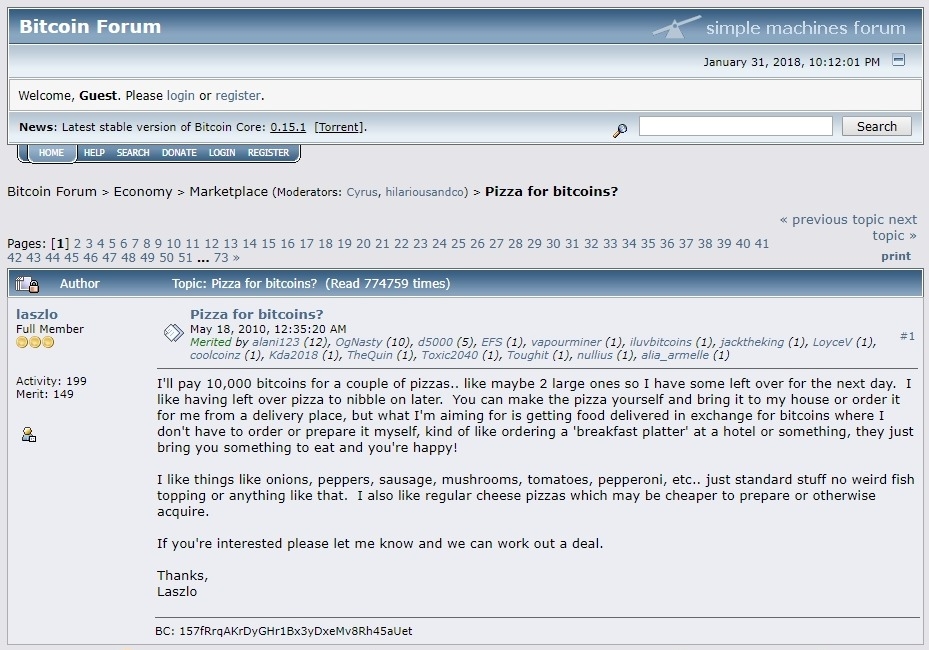

Well in the very beginning people used to mine bitcoin just as a hobby. As it had no market value. But soon it changed. In May 22, 2010 a person named Lazlo Hanyecz, created a forum in which he said, “i’ll pay 10,000 bitcoins for a couple of pizzas..”. A couple of pizzas was $25 at that time. After two days lazlo said that he was able to buy a couple of pizzas for $25, by using 10,000 BTC. This was the first time someone was able to buy or trade anything by using bitcoin. Hence, 22nd May is now known as, “Bitcoin Pizza Day”. By the end of the year, the value of bitcoin became 39 cents or $0.39. Also Mount Gox or MT gox was formed to easily transit money using bitcoin. In 2011 the price of bitcoin got raised to $1. Suddenly more new types of cryptocurrencies started to emerge in the market which followed the same rules as blockchain. At present there are 6000+ cryptocurrencies in the market.

In the very beginning bitcoin had to suffer because of various rumors, scandals & one of the greatest curse of IT called, “Misuse”. Because of the use of public and private keys the identity of users remained totally unknown. As a result various criminals & mafias could also use bitcoin for illegal purposes. And the IT sector has only one type of criminal in general. “Hackers”. “Silk Road '' an explicit & vulgar dark web website used bitcoin to trade Illegal Drugs through the internet. As a result the name Bitcoin got linked with the dark world of crime which is still alive. Another scandal was detected. And it was with Mount Gox. About 70% of bitcoin transactions took place with the alignment of bitcoin. In 2014, a scandal was published that Mount Gox did a bankruptcy of 850,000 missing bitcoins. And after the news got published the website of Mount Gox was closed forever. So if you have searched for mount gox after reading the name for the first time in this blog and found nothing more than a wikipedia page, then I’m sorry. This is the reality and reality is harsh.

You may be wondering that thank God bitcoin is absolutely useless, cruel and dark then tell you something that because of this scandal the popularity of bitcoin never decreased a little ‘bit’. Rather it gained more popularity. This is called negative advertising. Many websites and companies like bitpay, coingate etc were formed just like mount gox to align with the transaction of bitcoin. 2017 was the game changing year for bitcoin. In 2017 Japan made bitcoin legal. Now you can understand, if you’re from an asian country or your ancestors were asian that how much the asians love money. So bitcoin gained intense popularity in Asia along with japan. And the value of bitcoin rose up to $200k in that year. But there was an unnecessary craze among the people, which the company owners took advantage of. They started to use bitcoin payment and bitcoin logos to gain more attention from the people. And they became successful.

But understanding bitcoin was also not a piece of cake for everyone. You can’t gain access to the bitcoin network like how easily you get access to your wifi network or social media network. This requires higher knowledge & research. As a result people who thought that investing in bitcoin is similar to investing in a bank, suffered very badly. As a result, one of the superpowers of Asia, China, banned bitcoin trading. In 2014 Bangladesh Bank issued that no countries consider bitcoin as a coin and so Bangladesh will also not consider bitcoin as a valid currency. As a result, the market value of bitcoin started to drop and ultimately decreased by 80% than its highest value. But still the market value of bitcoin never dropped below $1000 till 2022.

Remember Sam Bank Friedman, the founder of crypto exchange company FTX. Sam Bank Friedman was a very talented person. But because of the jealousy of other large companies FTX is now worth only $1. And all this happened on November 11th, 2022 within 24hrs. FTX was the fastest growing organization in the crypto world. As a result, other big organizations like binance, Coinbase got a bit jealous of FTX. Sequoia, a venture capital fund, funded $210M to FTX and they also wrote a blog about why FTX will become one of the largest crypto exchange companies in the world. After that FTX became a billion dollar company by only 2 yrs, from 2020 to 2022. The market value of FTX was $31B with 1.5M registered members on the website. Before FTX gained this amount of popularity, Binance was the largest and top crypto exchange company in the world. Binance in the very beginning of the journey of FTX brought a small percentage of FTX which is known as Share in business. Biannce thought that they will use FTX as their sub company to handle some small works in remote places. But they never knew that FTX would rise like a phoenix. So, after FTX became a billion dollar company, Binance wanted to give back the share to FTX and return the “Stable Money” from FTX. When this thing happened people started to think that FTX has fallen down as Binance is giving back the share that they brought from FTX. As a result they went to the website of FTX and wanted their BItcoins back. Now it is normal that not only crypto banks but also the banks of the real world will also not have all the money that people deposited in the bank. Every bank in the world including crypto banks gives loans to their customers. As a result, FTX also didn’t have all the bitcoins of the people as they also gave it as loan to other people or companies. Hence, Sam Bankman closed the website of FTX and requested his customers that they can’t take their bitcoins at that moment. Normally when a bank fails to give back the deposit to their customers they face Bankruptcy or in American “Chapter 11”. Remember for whom all these things happened. Binance right? Well, during the bankruptcy of FTX, Binance said that they will buy FTX & save FTX from bankruptcy. But in the end they refused to do so. Because when they investigated the data & transaction files of FTX, they found out that many files were corrupted which can’t be resolved by any means. Thus a $31B company converted to a $1 company and all these things happened within 24hrs. Remember the blog that Sequoia Capital wrote about FTX. Yes, that blog is missing now from the internet and nowhere to be found.

Now the question is why is the value of bitcoin still increasing? Well the reason is many large & popular are moving their interest in bitcoin. Let us look at Elon Musk. he bought $1.5B worth bitcoin by Tesla, and also said that he’ll accept bitcoin as payment. Also, we all know about the famous doge meme right? Well this doge meme helped Elon musk gain more money for SpaceX. Elon Musk himself tweeted in the twitter that he didn’t invest a single penny, it was the meme that advertised the whole project. Also, The American Federal Reserve is continuously printing dollars to keep the economy alive, which may result in economic inflation. As a result of these initiatives, bitcoin which was considered as a currency changed to people’s personal territory, whose value will never decrease even in economic inflation, which can be reserved for the future and which can be sold at the right time for profit.

Reference:

https://en.wikipedia.org/wiki/Cryptocurrency

https://en.wikipedia.org/wiki/Blockchain

https://en.wikipedia.org/wiki/Bitcoin

https://youtu.be/v8PW8j17gSk

Comments

Post a Comment